Partnering to fix

your finances

From a financial mess to less stress

There’s infinite possibilities, questions, concerns, and doubts running thru your head. And, you don’t have the answers (and, the answers you dooo have are about marketing campaigns 😓).

If business were a sandbox, you’re playing on the beach. Infinite, overwhelming, and salty with huge waves crashing down beside you.

You need to build your playground and give your business structure. Slides, swings, and sand. But, sand on your terms within your structure with all the reassuring answers by your side – but with plenty of room to grow and freestyle. (Plus, maybe an ice cream truck tooo 🍦🤤)

Finance partnering creates that playground.

Phase One: building the playground

By the end of the diagnostic, you’ll have your business strategy mapped out and answers to those nagging questions:

🤓 What’s my business mission?

🤓 What do I really offer clients?

🤓 Who do I love working with?

🤓 Where are the opportunities?

🤓 What do I need to watch out for?

🤓 What’re my next steps?

🤓 What does my roadmap look like?

🤓 How do I streamline my invoicing process?

🤓 What’s my revenue capacity?

🤓 How many leads do I need?

🤓 How much should I save for taxes?

🤓 How much do I need for emergencies?

🤓 How much could I earn this year?

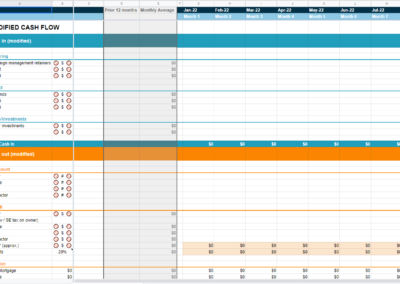

And, we’ll have made solid progress on the four levers of cash flow:

💸 Invoicing → better invoicing to bring money in on time

💸 Profitability → larger margins to give you more money to work with

💸 Savings → emergency funds to cover cash gaps

💸 Distributions → systemized distributions to plug the leaks

Then, we’ll keep you on the up and up with:

🤓 Weekly memos (aka, business journals) where you’ll detail your qualitative progress (including, the home runs, misses, hard-fought progress, and general musings). And, we’ll discuss all the minor questions that don’t warrant adding anotherrr meeting to your calendar.

🤓 Quarterly meetings where we’ll discuss the most important memo items, workshop major roadblocks, discuss your finances, and set new action items.

🤓 Continued progress on the four levers of cash flow so we can turn your foundation into rock-solid cash flow.

And, we call it — Operation Kickass 😤 (or whatever dope name motivates you 😋)

The Details

I’m supposed to sell the benefits and not the features. But, I’m a guy that likes details before making a purchase (or scheduling a call). And, this isn’t one of those ‘all hat, no cattle’ consulting programs that sells you on sex appeal, but leaves you nothing to show for it.

So, here’s the deets:

Yeaaa, I guess I sorta lied. There’s going to be a phase beforeee we get into the good stuff. We need to stabilize your agency before we can discuss strategy and finances. You could call this onboarding but I don’t.

We’ll start by stabilizing your cash flow. We’ll:

💸 Set living wage // salary

💸 Set quarterly tax distributions

💸 Set emergency fund target

Then, for the next 6 months, you’ll only pay yourself salary and taxes. Everything else will stay in your business for operating expenses, quarterly tax payments, and emergency savings.

Yea, that isn’t fun. But, we can’t fix cash flow without tackling your wages, tax payments, and emergency savings. And, you aren’t hiring me to keep things the same.

Then, we’ll round out Phase Zero with an expense audit. This admittedly isn’t any fun either, but it’s the fastest way to increase profitability. We’ll review your tech stack for low-hanging fruit and star expenses to get shopped around.

⏰ Timeline: within two weeks of starting

☎️ Number of calls: one

📑 Your pre-homework: a personal historic budget

Phase One: building the playground

Once you’re stabilized, we’ll work on your mid-term finances and strategy.

We’ll start with your invoicing and Accounts Receivable processes. These are frequently the easiest and most meaningful improvements you can make to your cash flow.

We’ll get you:

💸 Chasing late payments

💸 Updating your payment terms

💸 Collecting upfront

💸 Creating a dedicated follow-up process

💸 Implement any missing tech

Next, we’ll raise your prices. This isn’t an excuse to squeeze every penny out of your clients with ultra-high pricing and feel-good justifications. But, we tend to underprice ourselves. And, if you haven’t raised your prices in the last year, it’s time you review them.

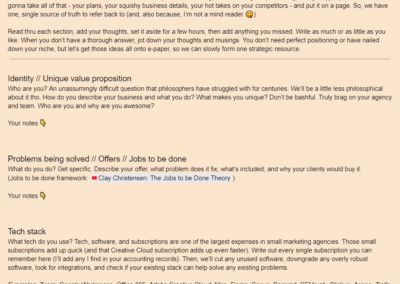

Then, we’ll wrap things up with some strategy fundamentals. We’ll expand on your Business Model Canvas and Goal Setting homework (yea, there’s homework). These strategy fundamentals will finally define your business (once and for all), create a foundation to build on, and bring all your stakeholders onto the same page (including yours truly).

We’ll iron out your:

🧠 Identity // Unique selling position

🧠 Problems being solved // Offers // Jobs to be done

🧠 Ideal client profile // Niche // Customer segments

🧠 Competition // Colleagues to learn from

🧠 Marketing channels

There’s a lot of marketing topics in there, but don’t worry, I’m not here to lecture you on marketing. I’m just making sure the cobbler has shoes.

Lastly, we’ll do some goal-setting exercises and road mapping before settling on your first few rocks to tackle in the next few months and adding them to your new strategy dashboard.

⏰ Timeline: within two months of starting

☎️ Number of calls: two to four (decided before starting)

📑 Your pre-homework: complete the business model canvas

Check out the forecast and Business Model Canvas worksheets 🧠

Once we’ve built the playground, answered those nagging questions, and put guardrails on your business, it’s ongoing maintenance time. We wanna keep things going smoothly, give you that year-round advice (and accountability), and workshop any major issues that crop up, without being overwhelming.

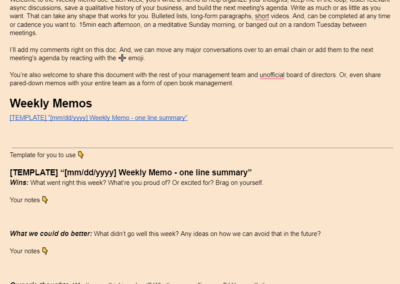

Every week, you’ll write a short memo detailing the wins, misses, progress, and general thoughts. These memos keep stakeholders (eg, operations, managers, consultants, etc) informed. And, when shared with employees, are a step towards greater transparency and Open Book Management.

We’ll also use these memos to asynchronously discuss issues in between meetings. Async chatting keeps things flexible to fit around your workday and personal life. And, it keeps meetings to a minimum to prevent meh meeting syndrome where you have lots of low-value, small-talk meetings with a consultant (and pay big bucks for the honor of wasting your time).

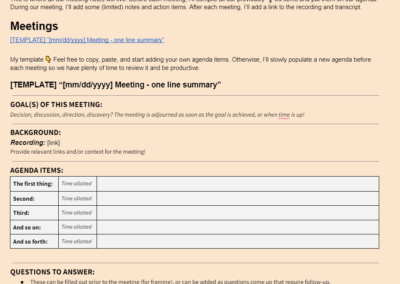

Then, we’ll meet once a quarter to workshop major issues and decide on the next round of goals & action items.

⏰ Timeline: recurring, annually renewed

☎️ Number of calls: one per quarter

✨ Async communication: weekly

📑 Your homework: weekly memos

Take a peek at the meeting agenda and weekly memo templates 👀

🤔 General FAQ 🤔

What kinda clients do you work with?

I typically work with small marketing and creative agencies (including freelancers and consultants) with up to 25 employees.

Can I expect confidentiality?

Yes. I do not share my client names, client list, or any details regarding my clients with anyone. The only way someone will know we’re working together is if you mentioned it to them or you’ve left a testimonial.

* I may draw inspiration from our conversations for LinkedIn posts or newsletter emails, but will never specifically name you, use details that might connect it to you, or shame you.

What’s the minimum commitment?

Both ‘Finance Partner’ and ‘Tax Essentials’ packages are 12-month commitments.

à la carte tax returns (both personal and business) are just that season’s tax return.

Do you offer one-off consulting calls?

Sure do. You can schedule one here.

Do you prepare à la carte tax returns without a monthly retainer?

Yes, but they do not include any year-round support, check-ups, letter support, or tax consults.

What factors affect your pricing?

‘Tax Essentials’ pricing depends on:

- your gross revenue

- number of partners

- number of states

- general complexity

‘Finance Partner’ pricing also depends on:

- how frequently we meet (you can choose monthly, quarterly, or something in between)

‘Bookkeeping & Reconciliations’ pricing depends on:

- the number of transactions

- how many checks you write

- complicated journal entries

- how frequently you’d like your books updated (you can choose monthly or quarterly)

What happens if I get audited?

‘Finance Partner’ and ‘Tax Essentials’ packages include letter protection. I’ll write letters and defend you at no additional charge to you.

Why a Chat instead of a Discovery Call?

Discovery calls are so formal.

I’m supposed to follow a discovery checklist and sales script. And, ask all sorts of big value questions

But, that ain’t me.

And, in all my years as an advisor and accountant, no one has ever wanted to jump right into full-blown discovery. Everyone has a preliminary few questions they wanna ask.

So, instead of slapping you with discovery right out of the gate, we’ll take it easy — schedule a call, you’ll ask your questions, and, I’ll ask mine. If you like my vibe, I’ll explain the next steps and discovery process.

(Note: This is an opportunity for you to ask about me, my practice, and how I can help you. And, while I might answer a few quick tax or finance questions because I can’t help myself, this isn’t a consulting call.)